In business partnerships, one of the most critical steps in protecting the company’s future is establishing a Buy-Sell Agreement (BSA). This legally binding contract outlines the terms for transferring ownership when certain triggering events occur—such as the death, disability, or voluntary exit of a business partner. Life insurance is one of the most effective methods to fund these agreements. By using life insurance to fund a Buy-Sell Agreement, business owners can ensure that the surviving partners have the liquidity needed to purchase the deceased partner’s shares without risking the business’s financial stability. Here’s a deeper dive into why life insurance is such a valuable tool in funding Buy-Sell Agreements.

The Importance of Buy-Sell Agreements

A Buy-Sell Agreement is crucial for any business with multiple owners. It provides a clear framework for transferring ownership in the event of an unforeseen circumstance, such as death or disability. Without a Buy-Sell Agreement, a business may face unwanted complications, such as:

- Family involvement: If a partner passes away without a Buy-Sell Agreement in place, their shares may be transferred to their family, creating potential conflicts in decision-making.

- Financial strain: Surviving partners may struggle to develop the necessary capital to purchase the deceased partner’s share, possibly requiring the business to liquidate assets or take on significant debt.

- Uncertainty: Without a predefined plan, the company’s future can become uncertain, leading to operational disruptions and the potential loss of clients, customers, and value.

Here are six business relationships that typically require a Buy-Sell Agreement:

- Partnerships

In a partnership, where two or more individuals share ownership of the business, a Buy-Sell Agreement ensures that the remaining partners can buy out a deceased or departing partner’s share, maintaining control and stability. - Limited Liability Companies (LLCs)

For LLCs with multiple members, a Buy-Sell Agreement can define the process for buying out a member’s interest in the event of death, disability, or other triggering events, ensuring that ownership transitions smoothly. - S Corporations

Shareholders of an S Corporation benefit from a Buy-Sell Agreement that outlines how to handle the transfer of shares, particularly in the event of the death or exit of a shareholder, while avoiding complications with the IRS. - C Corporations

Similar to S Corporations, C Corporations often require a Buy-Sell Agreement to ensure that ownership changes are managed properly, maintaining continuity and reducing the risk of outsiders gaining shares unexpectedly. - Family-Owned Businesses

In family-owned businesses, a Buy-Sell Agreement can help avoid disputes among family members regarding ownership after the death or retirement of a key member, ensuring that the business stays within the family or is properly managed. - Professional Practices

For professional businesses such as law firms, medical practices, or accounting firms, a Buy-Sell Agreement is essential to handle the transfer of ownership when a partner dies or retires, allowing for a fair transition and protecting clients and business relationships.

Each of these business types benefits from a well-structured Buy-Sell Agreement to prevent legal and financial complications during transitions of ownership.

How Life Insurance Helps Fund Buy-Sell Agreements

Life insurance provides a straightforward solution to funding a Buy-Sell Agreement. The core concept is that each business partner takes out a life insurance policy on the other(s) and names the business or the surviving partner as the beneficiary. This ensures that, in the event of a partner’s death, there will be enough funds to buy out the deceased partner’s share of the business, allowing for a smooth transition of ownership. Here’s how it works:

- Insurance Coverage: Each partner purchases a life insurance policy on the other(s) in an amount sufficient to cover the agreed-upon purchase price of the deceased partner’s shares.

- Liquidity Upon Death: When a partner passes away, the surviving business owners receive the death benefit from the life insurance policy, which provides the liquidity needed to buy the deceased partner’s shares.

- Prevents Draining Business Resources: By using life insurance, the business avoids dipping into its working capital or selling assets to fund the buyout. This allows the business to continue operations smoothly while providing fair value to the deceased partner’s estate or heirs.

Types of Buy-Sell Agreement Structures

There are three main structures for Buy-Sell Agreements, and life insurance can be adapted to fit each model:

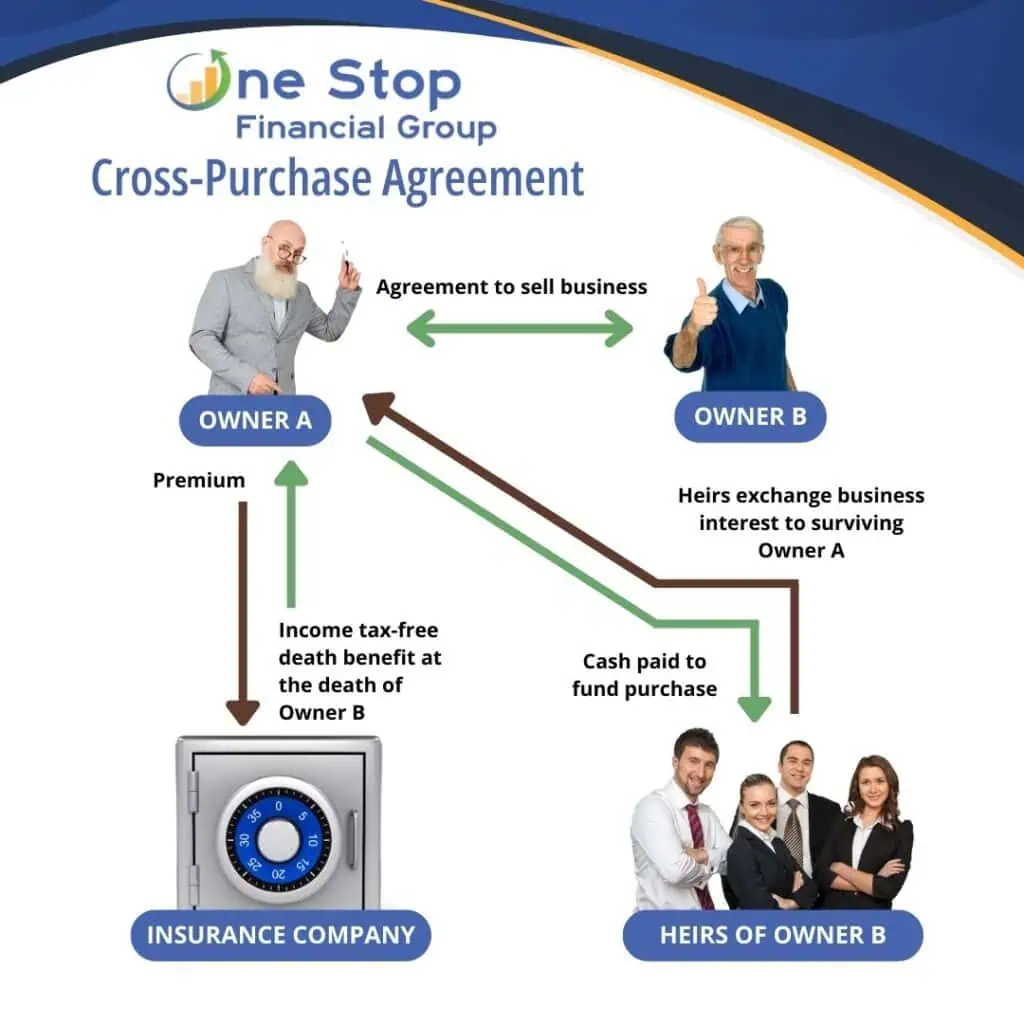

- Cross-Purchase Agreement: In a cross-purchase agreement, each business partner buys a life insurance policy on the others. In the event of a partner’s death, the surviving partners use the insurance proceeds to purchase the deceased partner’s share of the business.

- Entity-Purchase Agreement: In this structure, the business itself purchases life insurance policies on the partners. When a partner dies, the business uses the insurance proceeds to buy back the shares from the deceased partner’s estate.

Benefits of Using Life Insurance to Fund a Buy-Sell Agreement

- Guaranteed Value: Life insurance guarantees a certain payout, ensuring the funds will be available when needed.

- Tax Efficiency: Life insurance death benefits are typically paid out tax-free, allowing the surviving partners to use the full amount to fund the buyout.

- Simplicity and Certainty: A Buy-Sell Agreement funded by life insurance creates a straightforward and uncomplicated method for handling the death of a partner. The insurance proceeds provide immediate liquidity, and the buyout terms are predetermined, minimizing the likelihood of disputes.

- Preserves Business Stability: With life insurance in place, the business can maintain operations and avoid the financial strain that might arise in a buyout scenario.

Potential Pitfalls to Consider

While life insurance offers a strong funding mechanism for Buy-Sell Agreements, there are a few factors to keep in mind:

- Regular Reviews: Business valuations may change over time, so it’s essential to periodically review the life insurance coverage to ensure it reflects the business’s current value.

- Funding Mechanism: Life insurance policies have premiums that must be funded regularly. Ensure all business partners are on board with maintaining the policies over time.

- Ownership Structure: The specific structure of the Buy-Sell Agreement should align with the business’s goals and the financial circumstances of the partners. It may require the assistance of legal and financial advisors to ensure the proper framework.

In the world of business partnerships, a Buy-Sell Agreement is essential for protecting the company’s future and ensuring a smooth transition in the event of a partner’s death. Life insurance plays a vital role in funding these agreements by providing the necessary liquidity to purchase the deceased partner’s shares, all while safeguarding the business’s financial health. Business owners should carefully consider the benefits and potential pitfalls of using life insurance for their Buy-Sell Agreement and regularly review their coverage to ensure it aligns with the evolving value of the business.

If you want to create a Buy-Sell Agreement for your business or explore life insurance options to fund it, consult an experienced financial advisor to help structure the right plan for your specific needs. Protect your business today so that it can thrive tomorrow.

Contact One Stop Financial Group today to discuss how life insurance can be used to fund your Buy-Sell Agreement and secure your business’s future. Don’t leave the fate of your company to chance—ensure that your legacy is protected.

Article Sources: Forbes Advisor, The Balance Small Business, Investopedia, Life Insurance Settlement Association, National Association of Insurance and Financial Advisors, SBA, and IRS.