In today’s competitive and unpredictable environment, protecting a business’s most valuable resources—its assets and key employees—is essential for long-term success and stability. One effective way to achieve this is through business life insurance, which provides critical financial protection in the event of the loss of an important team member or business owner. At One Stop Financial Group, we recognize the unique challenges businesses face, and we are dedicated to helping you implement tailored strategies to safeguard your company’s future.

What is Key Person Insurance?

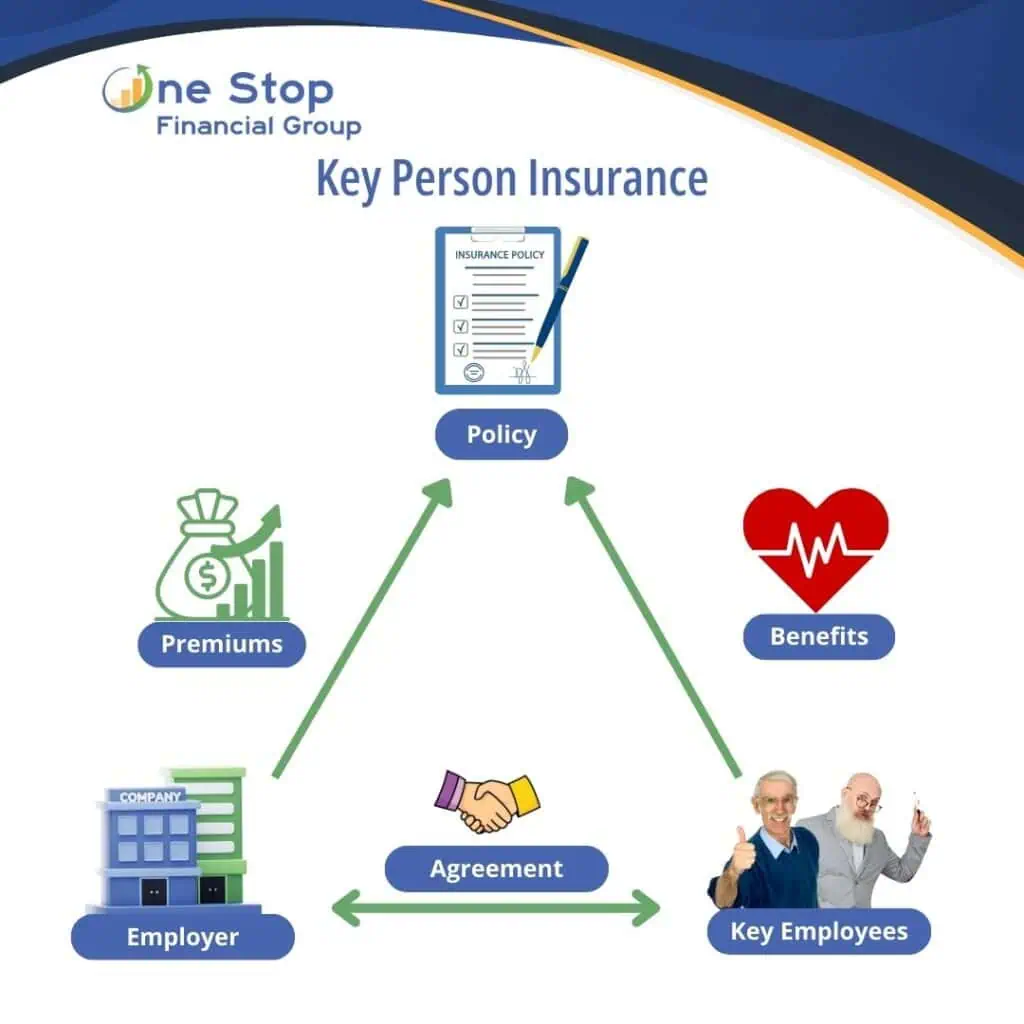

Key Person Insurance, aka Business life is a specialized type of life insurance designed to meet the needs of businesses. It provides a financial safety net for the company in the event of the unexpected loss of a key employee, owner, or business partner. From key person insurance to buy-sell agreements, business life insurance can be tailored to fit the specific requirements of your organization, ensuring continuity and financial stability when it’s needed most.

Key Benefits of Business Life Insurance

1. Protecting Key Personnel

Losing a key employee can be a significant setback, affecting everything from daily operations to long-term growth. Key person insurance is a form of life insurance that protects the business financially if an owner, executive, or highly skilled employee passes away unexpectedly. This insurance provides a financial cushion, enabling the business to cover expenses like hiring and training a replacement, maintaining customer relationships, and handling temporary revenue shortfalls. Key person insurance helps ensure that the company can continue to thrive despite the loss of an invaluable contributor.

2. Facilitating Buy-Sell Agreements

For businesses with multiple owners, a buy-sell agreement supported by life insurance is essential. This legal document dictates how ownership shares will be transferred in the event of an owner’s death, disability, or departure. Life insurance policies provide the necessary funds to buy out the deceased owner’s share from their family, allowing the remaining partners to retain control without taking on additional debt. This arrangement ensures financial security for both the business and the family of the deceased, allowing for a smooth transition without compromising the company’s future.

3. Supporting Business Continuity

Business life insurance plays an integral role in business continuity planning, providing financial support during unforeseen disruptions. A life insurance payout can be instrumental in managing payroll, paying off outstanding debts, or covering legal and administrative costs associated with a leadership transition. This financial flexibility is critical to maintaining operations and securing the business’s long-term future.

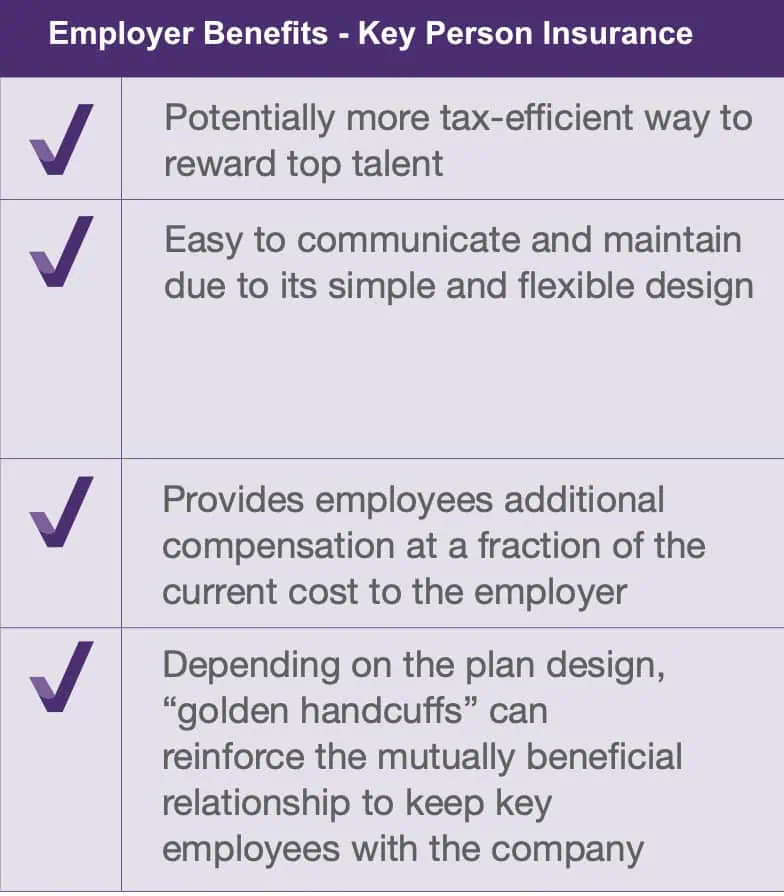

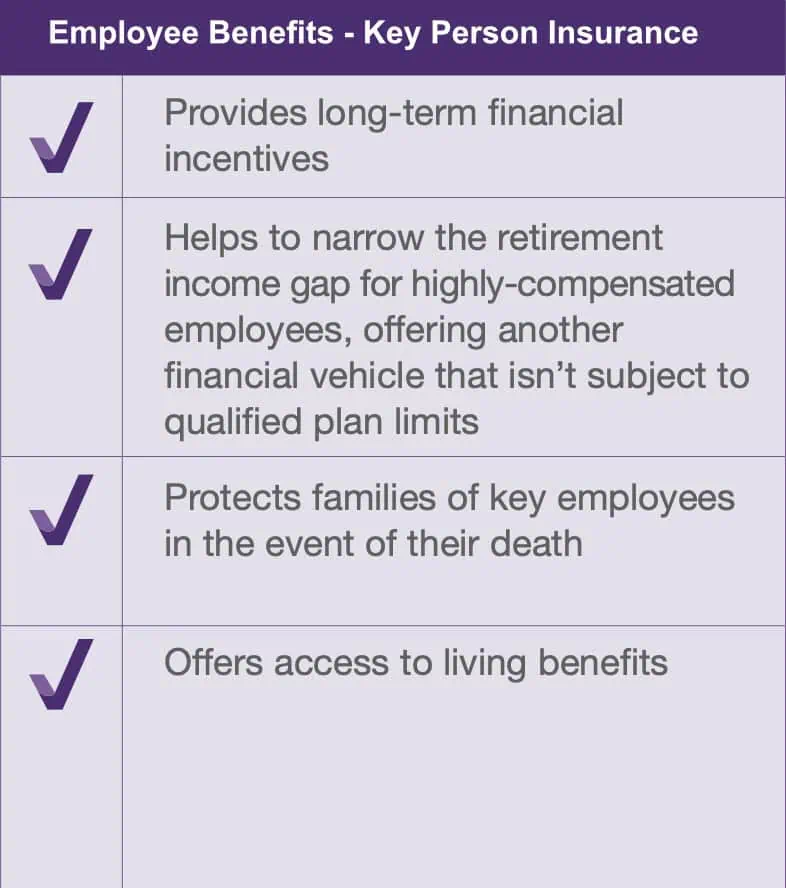

4. Enhancing Employee Retention and Recruitment

In a competitive job market, offering life insurance as part of your employee benefits package can help attract and retain top talent. By including group life insurance coverage, businesses show their employees that they are valued, which fosters loyalty and long-term commitment. Providing life insurance benefits not only enhances job satisfaction but also reinforces the company’s commitment to its team’s well-being.

Conclusion

Business life insurance is more than just a precaution; it is a strategic investment in the future of your company. At One Stop Financial Group, we are committed to helping businesses in Louisiana, Mississippi, and beyond protect their most valuable assets. Our team works with you to identify and implement insurance solutions that provide peace of mind and financial security. Contact us today to learn more about how business life insurance can support your company’s growth and stability.

For tailored guidance on business life insurance or consultation, contact One Stop Financial Group at (504) 300-8207 or visit our website at www.onestopfinancialgroup.net. Let us help you safeguard your business and plan confidently for the future.